SSI Benefits for Disabled Individuals in the U.S.: A Simple Guide

Who Qualifies for SSI?

Supplemental Security Income (SSI) is a federal program in the U.S. designed to help people with limited income and resources who are aged, blind, or disabled. To qualify for SSI as a disabled individual, you must meet specific criteria set by the Social Security Administration (SSA).

First, you must have a medically determinable physical or mental impairment that significantly limits your ability to perform basic work activities. This condition must have lasted or be expected to last at least 12 months or result in death. Children with disabilities can also qualify if their condition severely limits their daily functioning.

Second, your income and resources must fall below certain limits. In 2024, individuals must have less than $2,000 in countable resources ($3,000 for couples). Countable income includes wages, Social Security benefits, and other sources, but not all income is counted. For example, the first $20 of most income and the first $65 of earnings are excluded.

Third, you must be a U.S. citizen or meet specific non-citizen requirements, such as being a lawful permanent resident who meets additional criteria.

Understanding these qualifications can help you or a loved one take the first step toward financial support. For the most accurate and up-to-date information, visit the official SSA website: https://www.ssa.gov/ssi/

How to Apply for SSI Benefits

Applying for Supplemental Security Income (SSI) benefits can feel overwhelming, but the process is more manageable when you know what to expect. SSI is a federal program that provides monthly payments to individuals with limited income and resources who are disabled, blind, or age 65 and older. Here’s a step-by-step guide to help you or a loved one apply with confidence.

1. Check Your Eligibility: Before applying, make sure you meet the basic requirements. You must have a qualifying disability, limited income and resources, and be a U.S. citizen or meet specific immigration criteria. You can use the SSA’s Benefit Eligibility Screening Tool to check: https://ssabest.benefits.gov/

2. Gather Necessary Documents: Collect documents such as your Social Security number, birth certificate, proof of income, bank statements, medical records, and information about your living arrangements. Having these ready will speed up the process.

3. Start the Application:

– Online: You can begin the application for an adult with a disability at the SSA website (https://www.ssa.gov/benefits/ssi/).

– By Phone: Call the Social Security Administration at 1-800-772-1213 to schedule an appointment.

– In Person: Visit your local Social Security office. It’s a good idea to call ahead and make an appointment.

4. Complete the Interview: After submitting your application, you’ll likely be scheduled for an interview. This can be done by phone or in person. Be honest and thorough in providing information about your condition and financial situation.

5. Wait for a Decision: The SSA will review your application and may request additional medical evaluations. This process can take several months, so patience is key. You’ll receive a letter in the mail with their decision.

Applying for SSI benefits is a significant step toward financial stability for many individuals with disabilities. By understanding the process and preparing in advance, you can improve your chances of a successful application.

Monthly Payments and State Add-Ons

Supplemental Security Income (SSI) provides monthly financial support to individuals with disabilities who have limited income and resources. The base federal SSI payment amount is set annually by the Social Security Administration (SSA). As of 2024, the maximum federal benefit is $943 per month for individuals and $1,415 for couples. However, the actual amount a person receives may be lower depending on other income sources.

In addition to the federal benefit, many states offer extra payments known as state supplements or state add-ons. These additional funds vary widely by state and are designed to help cover the higher cost of living or specific needs. For example, California, New York, and Massachusetts provide relatively generous state supplements, while others like Texas do not offer any additional payment.

Eligibility for state add-ons often depends on factors such as living arrangements, income, and disability status. Some states administer their own payments, while others have the SSA manage them directly. To find out what’s available in your state, it’s best to contact your local Social Security office or visit the SSA’s official website.

Understanding these payments can help individuals with disabilities better plan their monthly budgets and access additional support they may not be aware of.

For more detailed information, visit the official SSA page: https://www.ssa.gov/ssi/text-benefits-ussi.htm

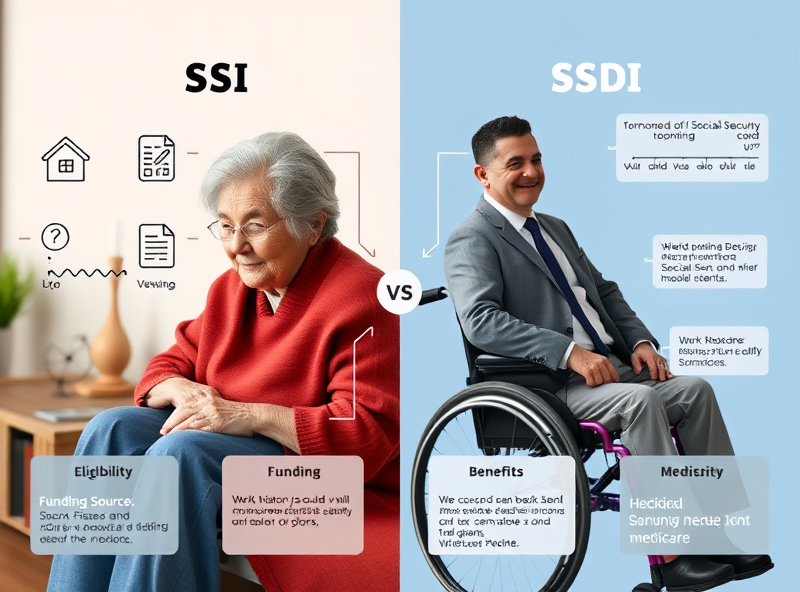

SSI vs SSDI: What’s the Difference?

If you’re navigating disability benefits in the U.S., it’s important to understand the difference between SSI (Supplemental Security Income) and SSDI (Social Security Disability Insurance). While both programs provide financial assistance to people with disabilities, they serve different groups and have different eligibility requirements.

SSI is a needs-based program for individuals with limited income and resources. It’s funded by general tax revenues, not Social Security taxes. To qualify, you must have a disability (or be aged 65 or older), and meet strict income and asset limits. SSI is often the only option for people who have never worked or haven’t worked enough to qualify for SSDI.

SSDI, on the other hand, is an insurance program for people who have worked and paid Social Security taxes. To be eligible, you must have a qualifying disability and a sufficient work history. SSDI benefits are typically higher than SSI, and recipients may also qualify for Medicare after a 24-month waiting period.

Understanding the distinction can help you apply for the right program and get the support you need. For more detailed information, you can visit the official Social Security Administration page: https://www.ssa.gov/benefits/disability/