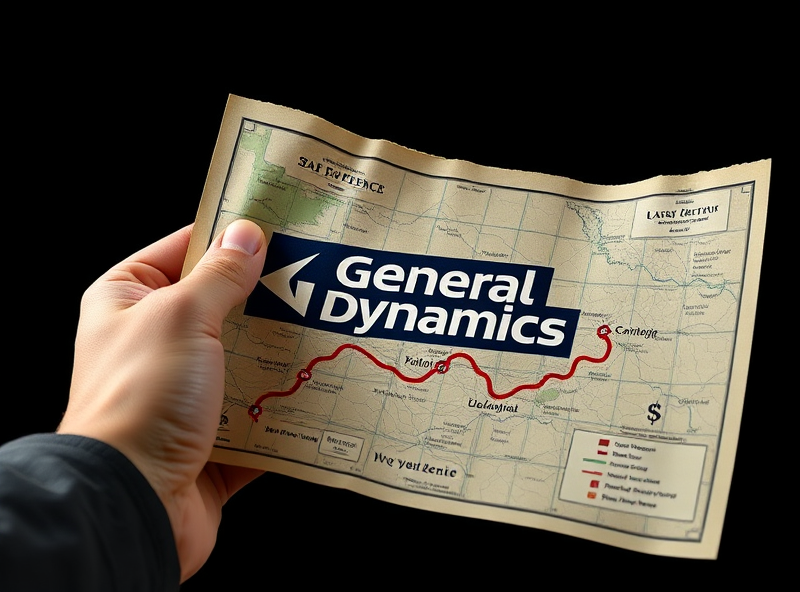

General Dynamics (GD) Stock: An Investor’s Guide to the Defense Giant

Hey there, fellow investors! If you’ve ever wondered about investing in America’s defense industry, you’ve probably come across General Dynamics Corporation (NYSE: GD). This isn’t just another boring defense contractor – it’s actually one of the most fascinating companies in the aerospace and defense sector, with fingers in everything from luxury business jets to nuclear submarines. Let me walk you through why GD might deserve a spot in your investment portfolio.

What Makes General Dynamics Special?

Think of General Dynamics as the Swiss Army knife of defense companies. While some firms focus on just aircraft or just weapons, GD has built an impressive empire across four completely different areas. It’s like owning a piece of four different companies rolled into one stock – pretty cool, right?

Founded way back in 1952, General Dynamics has grown into one of America’s most trusted defense partners. The company employs over 100,000 people worldwide and generates annual revenues of approximately $42 billion. But here’s what really sets them apart: they’ve managed to balance government contracts with commercial success in ways that many competitors haven’t.

Breaking Down the Business: Four Powerhouse Divisions

Let me introduce you to GD’s four main business segments – each one tells a unique story about American innovation and global reach.

Gulfstream Aerospace: Where Luxury Meets Technology

This is probably the most glamorous part of General Dynamics, and honestly, it’s pretty exciting! Gulfstream manufactures some of the world’s most sophisticated business jets. We’re talking about aircraft that can fly from New York to Tokyo nonstop, equipped with technology that would make NASA jealous.

What’s great about this division is that it serves wealthy individuals, Fortune 500 companies, and governments worldwide. When the global economy is humming along nicely, demand for these jets typically soars. The average Gulfstream jet sells for $40-75 million, so you can imagine the kind of profit margins we’re talking about here.

The beauty of the Gulfstream business is its recurring revenue model. Once someone buys a $60 million jet, they need ongoing maintenance, parts, and services for decades. It’s like having a luxury car dealership that also runs the only authorized service center in town.

Marine Systems: Building America’s Naval Strength

Now this is where things get really impressive from a national security perspective. General Dynamics’ Marine Systems division is one of only two companies in America capable of building nuclear submarines. Think about that for a moment – this is some seriously exclusive territory.

They’re currently building Virginia-class attack submarines and Columbia-class ballistic missile submarines for the U.S. Navy. Each submarine contract is worth billions of dollars and takes years to complete. It’s like having a guaranteed income stream that stretches out for decades.

The division also builds destroyers and other naval vessels. With growing concerns about China’s naval expansion and global maritime security, demand for these capabilities continues to grow. The U.S. Navy has made it clear they want more submarines, faster – and General Dynamics is one of the few companies that can deliver.

Combat Systems: Boots on the Ground Technology

This division focuses on land-based military equipment, and they make some seriously impressive stuff. Ever heard of the M1 Abrams tank? That’s their baby. They also produce the Stryker combat vehicle, which has become a workhorse for the U.S. Army.

What’s particularly interesting about Combat Systems is how they’ve adapted to modern warfare. It’s not just about building bigger, heavier tanks anymore. Today’s military needs lighter, more agile vehicles with advanced electronics and communication systems. General Dynamics has been at the forefront of this evolution.

The division also manufactures ammunition and provides maintenance services for military vehicles worldwide. With ongoing conflicts and the need for military modernization globally, this segment provides steady demand for GD’s products and services.

Information Technology & Mission Systems: The Digital Defense Revolution

This might be the most underappreciated part of General Dynamics, but it’s absolutely crucial for the future. Through their GDIT (General Dynamics Information Technology) subsidiary, they provide IT services to government agencies and commercial clients.

We’re talking about cybersecurity, cloud computing, data analytics, and communication systems. In today’s world, wars are increasingly fought in cyberspace, and General Dynamics is helping to build America’s digital defenses.

This division also works on classified projects that we can’t even know about – which is both mysterious and reassuring from an investment perspective. When the government needs someone they can trust with their most sensitive technology projects, General Dynamics often gets the call.

The Investment Appeal: Why Smart Money Likes GD

Dividend Aristocrat Status: Your Money Working Hard

Here’s something that’ll make income investors smile: General Dynamics is a Dividend Aristocrat, meaning they’ve increased their dividend payment for over 25 consecutive years. In a world where many companies cut dividends at the first sign of trouble, GD has been remarkably consistent.

Currently yielding around 2.5-3%, the dividend might not look spectacular compared to some REITs or utilities, but remember – this dividend has grown every single year for more than two decades. That’s the power of compound growth working in your favor.

What makes this dividend so reliable? Long-term government contracts provide predictable cash flows, and the company has built a culture of financial discipline that prioritizes shareholder returns alongside business investments.

Recession-Resistant Revenue Streams

One thing I really appreciate about General Dynamics is how their business model provides some protection during economic downturns. While the Gulfstream division might see reduced demand during recessions, the defense segments often remain stable or even grow during uncertain times.

Government defense spending doesn’t disappear during recessions – if anything, geopolitical tensions often increase during periods of economic stress. This provides a natural hedge against economic cycles that pure commercial companies don’t enjoy.

Long-Term Contract Visibility

Unlike companies that have to chase new customers every quarter, General Dynamics has a massive backlog of signed contracts. We’re talking about $90+ billion in total backlog, representing several years of future revenue that’s already locked in.

This visibility is incredibly valuable for long-term investors. You can sleep well at night knowing that a significant portion of GD’s future revenue is already contracted and committed.

Understanding the Risks: What Could Go Wrong?

Let’s be honest – no investment is without risks, and General Dynamics has some unique challenges that potential investors should understand.

Government Budget Volatility

While defense spending is generally stable, it’s not immune to political changes. Budget cuts, program cancellations, or shifts in military priorities can impact GD’s business. The company has diversified across multiple programs and customers to reduce this risk, but it’s still something to watch.

Program Execution Challenges

Building submarines and combat vehicles isn’t like manufacturing smartphones. These are incredibly complex projects that can face technical challenges, cost overruns, or delays. When things go wrong on a multi-billion-dollar submarine program, it can significantly impact profitability.

Gulfstream’s Economic Sensitivity

The business jet market can be quite cyclical. During economic downturns, companies and wealthy individuals often delay aircraft purchases. This segment, while profitable during good times, can be a drag on overall performance during recessions.

Competitive Pressures

The defense industry is highly competitive, with companies constantly bidding against each other for lucrative government contracts. Losing a major competition can mean years of reduced revenue in that particular segment.

Current Market Position and Financial Health

Let’s talk numbers for a moment. General Dynamics typically generates strong free cash flow – often $3-4 billion annually. This cash generation capability supports both dividend payments and share buyback programs while still allowing for necessary business investments.

The company maintains a conservative balance sheet with manageable debt levels. This financial strength provides flexibility during challenging periods and the ability to invest in growth opportunities when they arise.

Return on invested capital has consistently been above 15%, which is excellent for a large industrial company. This indicates that management is doing a good job of deploying shareholder capital effectively.

Growth Catalysts: What Could Drive Future Returns?

Naval Expansion Programs

The U.S. Navy has ambitious plans to expand its submarine fleet, and General Dynamics is positioned to benefit significantly. The Columbia-class submarine program alone represents decades of work and tens of billions in revenue.

International Opportunities

While GD’s primary customer is the U.S. government, international sales are growing. Allied nations are increasingly interested in American-made defense equipment, providing additional growth opportunities beyond domestic spending.

Technology Integration

The convergence of traditional defense capabilities with advanced technology creates new opportunities. Think artificial intelligence in combat vehicles, advanced materials in aircraft, and cybersecurity integration across all platforms.

Commercial Aviation Recovery

As global economic growth continues, demand for business jets should recover and potentially exceed pre-pandemic levels. The trend toward private aviation, accelerated by COVID-19, could provide a long-term tailwind for Gulfstream.

Investment Strategies: How to Approach GD Stock

For Income Investors

GD’s reliable dividend growth makes it attractive for investors seeking steady income with inflation protection. The combination of current yield and consistent increases provides a compelling total return proposition over time.

For Growth Investors

While GD isn’t a high-growth tech stock, it offers steady, predictable growth supported by long-term contracts and expanding defense budgets. The company’s technological capabilities position it well for future defense needs.

For Value Investors

During market downturns or company-specific challenges, GD stock sometimes trades at attractive valuations relative to its earnings and cash flow generation. Patient investors can potentially find good entry points during these periods.

Comparing GD to Competitors

In the defense sector, General Dynamics competes with companies like Lockheed Martin, Raytheon Technologies, and Boeing’s defense division. What sets GD apart is its unique combination of naval capabilities (submarines), luxury aviation (Gulfstream), and IT services.

This diversification can be both a strength and a weakness. While it provides stability, it also means GD might not be the pure-play investment that some investors prefer in specific defense sectors.

Looking Ahead: The Future of Defense Investing

The global security environment continues to evolve, with new threats requiring new solutions. General Dynamics’ broad capabilities position it well to adapt to changing defense needs.

Emerging areas like space defense, cyber warfare, and autonomous systems represent potential growth opportunities. The company’s strong research and development capabilities and close government relationships provide advantages in pursuing these new markets.

The Bottom Line: Is GD Right for Your Portfolio?

General Dynamics offers something relatively rare in today’s market: a combination of stability, growth, and income in a strategically important industry. The company’s diverse business model, strong financial position, and reliable dividend make it an interesting consideration for many portfolios.

However, like any investment, GD isn’t right for everyone. If you’re looking for explosive growth or are uncomfortable with defense industry exposure, you might want to look elsewhere. But if you appreciate steady, predictable businesses with strong competitive positions and reliable shareholder returns, General Dynamics deserves serious consideration.

The key to success with GD stock is understanding what you’re buying: a well-managed, diversified defense company with strong government relationships and a track record of consistent performance. It’s not going to make you rich overnight, but it might just provide the steady, reliable returns that form the backbone of a solid investment portfolio.

Remember, successful investing is often about finding companies that can compound returns over many years. General Dynamics, with its long-term contracts, technological expertise, and shareholder-friendly management, fits that description quite well.

Investment Disclaimer: This analysis is provided for educational and informational purposes only. It should not be considered personalized investment advice. Defense industry investments carry unique risks related to government spending and geopolitical factors. Always conduct your own research and consider consulting with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

About This Analysis: This comprehensive review was prepared by experienced financial analysts specializing in aerospace and defense sector investments. For more insights on defense stocks and market analysis, be sure to check out our other investment guides and market commentary.