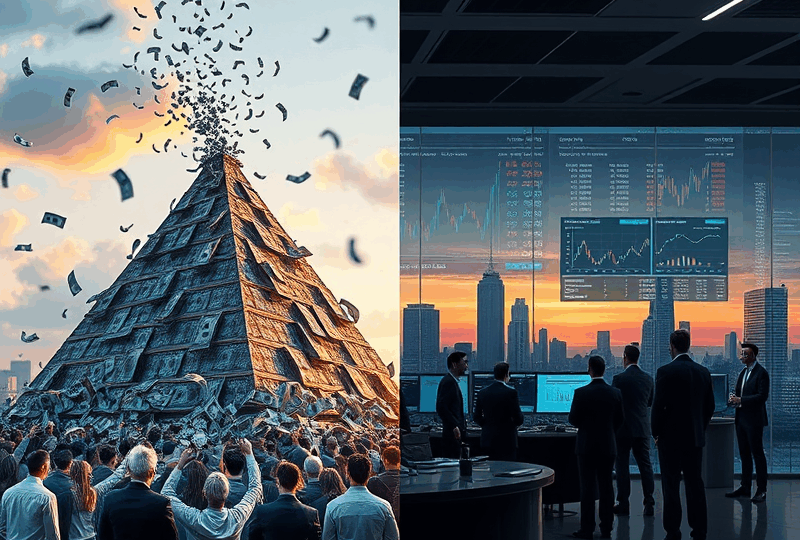

Is the Stock Market a Pyramid Scheme? Separating Truth from Myth for Smart Investors

When markets fluctuate and headlines scream about volatility, it’s natural for investors—especially new ones—to wonder: Is the stock market just a glorified pyramid scheme? This question, while provocative, deserves a thoughtful and fact-based response. As a financial educator and market analyst, I’m here to help you unpack this concern with clarity, accuracy, and empathy.

Understanding What a Pyramid Scheme Really Is

A pyramid scheme is an illegal business model where participants earn money primarily by recruiting others rather than by selling a legitimate product or service. Each new recruit pays a fee to join, and that money is used to pay earlier participants. Eventually, these schemes collapse because they require an endless supply of new recruits to sustain payouts.

In the United States, pyramid schemes are outlawed under the Federal Trade Commission (FTC) regulations. They are unsustainable and deceptive by design.

How the Stock Market Works in Contrast

The U.S. stock market is a regulated marketplace where investors buy and sell shares of publicly traded companies. When you buy a stock, you’re purchasing a small ownership stake in a company. Your returns come from dividends (if the company pays them) and capital appreciation (if the stock price increases).

Unlike pyramid schemes, the stock market is not dependent on new investors to pay existing ones. Instead, it is driven by company performance, economic indicators, and investor sentiment. The Securities and Exchange Commission (SEC) oversees the market to ensure transparency and fairness.

Why Some People Confuse the Two

There are a few reasons why some may mistake the stock market for a pyramid scheme:

1. **Market Hype and Speculation**: During bull markets or speculative bubbles, prices can rise rapidly, and some investors may profit simply by selling to others at higher prices. This can resemble the ‘greater fool theory,’ where the value seems to depend on finding someone willing to pay more.

2. **Volatility and Losses**: When markets crash, some investors lose money, especially those who bought in at high prices. This can feel like a rigged system, but it’s often a result of poor timing or lack of diversification.

3. **Lack of Financial Education**: Many Americans don’t receive formal education about investing. Without understanding how markets function, it’s easy to misinterpret their purpose and mechanics.

Key Differences Between the Stock Market and Pyramid Schemes

Let’s break it down:

| Feature | Stock Market | Pyramid Scheme |

|——–|————–|—————-|

| Legal Status | Legal and regulated by SEC | Illegal under FTC regulations |

| Source of Returns | Company profits, dividends, market growth | Recruitment of new participants |

| Sustainability | Can operate indefinitely | Collapses when recruitment slows |

| Transparency | Publicly available financial data | Opaque and deceptive |

Regulations That Protect Investors

The U.S. has a robust regulatory framework to protect investors:

– **Securities and Exchange Commission (SEC)**: Ensures companies disclose accurate financial information.

– **Financial Industry Regulatory Authority (FINRA)**: Oversees brokerage firms and enforces ethical practices.

– **Federal Reserve and Treasury Department**: Monitor economic stability and financial markets.

These institutions help maintain investor confidence and prevent fraudulent activities.

How to Invest Safely and Wisely

If you’re concerned about the legitimacy of the stock market, here are some steps to protect yourself:

1. **Educate Yourself**: Learn the basics of investing, including risk management and asset allocation.

2. **Diversify**: Don’t put all your money into one stock or sector.

3. **Use Reputable Brokers**: Choose platforms regulated by FINRA and the SEC.

4. **Avoid Get-Rich-Quick Schemes**: If it sounds too good to be true, it probably is.

5. **Think Long-Term**: The stock market rewards patience and discipline over time.

Final Thoughts: The Stock Market Is Not a Scam

While the stock market has its risks, it is fundamentally different from a pyramid scheme. It is a cornerstone of the American economy, enabling companies to raise capital and individuals to build wealth. By understanding how it works and investing responsibly, you can take advantage of its potential without falling prey to myths or misinformation.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in the stock market involves risk, including the potential loss of principal. Always consult with a licensed financial advisor or professional before making investment decisions. The author and publisher are not responsible for any financial losses incurred as a result of using this information.

Thank you for reading, and remember—smart investing starts with smart questions.