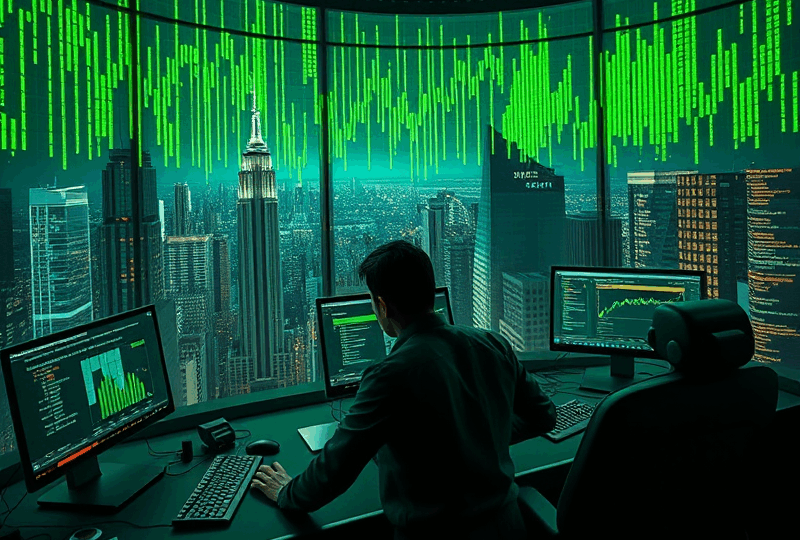

Stock Market Like the Matrix: How to Decode Market Reality and Escape the Illusion

Have you ever felt like the stock market is a simulation—numbers flashing, headlines screaming, and prices moving in ways that seem disconnected from reality? You’re not alone. In fact, many investors feel overwhelmed by the noise and manipulation that often cloud true market signals. Just like Neo in The Matrix, the key to success is learning to see through the illusion and understand the deeper mechanics at play.

Understanding the Market Illusion

The stock market is a complex system influenced by a multitude of factors: corporate earnings, economic indicators, geopolitical events, investor sentiment, and even algorithms. However, much of what we see on the surface—daily price swings, media hype, and social media trends—can be misleading. This is what we call the “market illusion.”

Retail investors are especially vulnerable to this illusion. High-frequency trading, institutional manipulation, and algorithmic strategies can distort price action, making it difficult to distinguish between genuine market movements and artificial volatility.

Decoding the Matrix: Key Principles

To navigate the market effectively, you need to decode the illusion. Here are several principles to help you see the market for what it truly is:

1. Focus on Fundamentals: Don’t get distracted by short-term noise. Analyze a company’s earnings, balance sheet, and long-term prospects. Look at key metrics like P/E ratio, debt-to-equity, and free cash flow.

2. Understand Macro Trends: Economic indicators such as GDP growth, unemployment rates, inflation, and interest rates have a significant impact on market direction. Stay informed through reliable sources like the Bureau of Economic Analysis (BEA) and Federal Reserve reports.

3. Beware of Media Hype: Financial news outlets often prioritize sensationalism over substance. Use them as a starting point, but always verify information with data and independent analysis.

4. Learn Technical Analysis: While fundamentals tell you what to buy, technical analysis helps you decide when to buy. Understanding chart patterns, support/resistance levels, and volume trends can give you an edge.

5. Control Your Emotions: Fear and greed are powerful forces. Develop a disciplined investment strategy and stick to it, even when the market gets volatile.

How Algorithms Shape Market Reality

Today, over 70% of trading volume in U.S. markets is driven by algorithms. These high-frequency trading (HFT) systems can execute thousands of trades in milliseconds, often exploiting micro-movements that are invisible to the average investor.

This means that what looks like a natural price movement may actually be the result of programmed trades. Understanding this can help you avoid panic-selling or buying into artificial rallies.

Escaping the Illusion: Building a Reality-Based Strategy

Escaping the illusion doesn’t mean ignoring the market—it means learning to interpret it correctly. Here’s how to build a strategy grounded in reality:

– Use Data-Driven Tools: Platforms like Morningstar, Finviz, and Seeking Alpha offer in-depth analysis and screening tools.

– Diversify Intelligently: Spread your investments across sectors and asset classes to reduce risk.

– Think Long-Term: Warren Buffett famously said, “The stock market is a device for transferring money from the impatient to the patient.” Adopt a long-term mindset.

– Stay Educated: Read books like “The Intelligent Investor” by Benjamin Graham or “A Random Walk Down Wall Street” by Burton Malkiel.

Real-World Example: The 2020 Pandemic Crash

In March 2020, the U.S. stock market plunged due to fears surrounding COVID-19. Media headlines predicted economic collapse. However, within months, the market rebounded sharply, driven by stimulus packages, low interest rates, and tech sector growth.

Investors who reacted emotionally and sold at the bottom missed out on one of the fastest recoveries in history. Those who saw through the illusion and held firm were rewarded.

Final Thoughts

The stock market may feel like the Matrix, but you don’t need to be a chosen one to succeed. By focusing on fundamentals, understanding macroeconomic trends, and maintaining emotional discipline, you can decode the market and make informed decisions.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Investing in the stock market involves risk, including the loss of principal. Always conduct your own research or consult with a licensed financial advisor before making investment decisions.

Stay Awake, Stay Informed

The illusion is powerful, but knowledge is more powerful. Keep learning, stay skeptical, and remember: the truth is out there—you just have to know where to look.