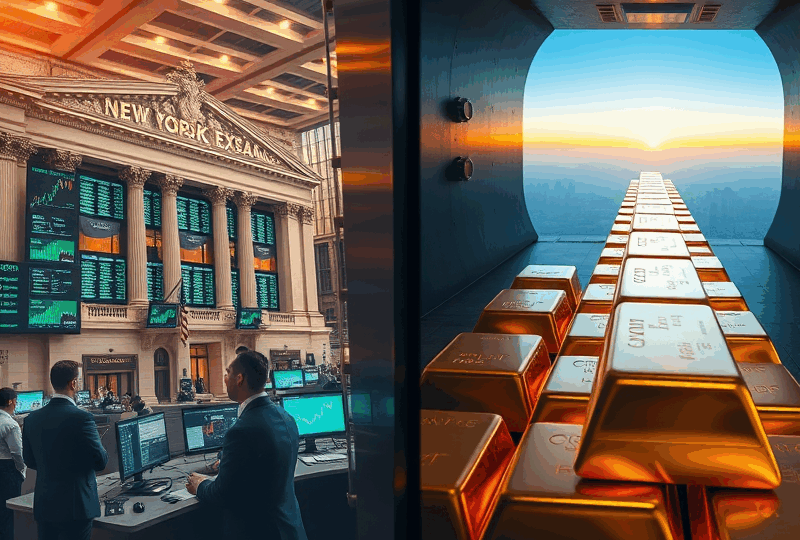

Stock Market vs Gold: Best Long-Term Investment Strategy for Americans

When it comes to securing your financial future, choosing the right long-term investment strategy is crucial. For many Americans, the debate often centers around two popular options: the stock market and gold. Both have their unique advantages and risks, and understanding their behavior over time can help you make a more informed decision.

Understanding the Stock Market

The U.S. stock market, represented by indices like the S&P 500 and the Dow Jones Industrial Average, has historically been one of the most effective vehicles for long-term wealth accumulation. Over the past century, the average annual return of the S&P 500 has hovered around 10%, before inflation. This includes periods of economic boom, recessions, and even global crises.

Investing in stocks means owning a piece of a company. As companies grow and generate profits, their stock prices tend to rise, providing capital appreciation. Additionally, many stocks pay dividends, offering a stream of passive income.

However, the stock market is inherently volatile. Short-term fluctuations can be dramatic, as seen during the 2008 financial crisis or the COVID-19 pandemic. But historically, long-term investors who stay the course tend to be rewarded.

The Case for Gold

Gold has been a store of value for thousands of years. Unlike stocks, gold is a tangible asset that isn’t tied to the performance of a single company or economy. It tends to perform well during times of economic uncertainty, inflation, or geopolitical instability.

During the 1970s, for example, when inflation in the U.S. was high, gold prices surged. More recently, during the 2008 financial crisis and the early stages of the COVID-19 pandemic, gold again saw significant gains as investors sought safety.

However, gold does not generate income. It doesn’t pay dividends or interest, and its long-term appreciation has generally lagged behind the stock market. From 1971 (when the U.S. left the gold standard) to 2023, gold has returned about 7.7% annually, compared to the S&P 500’s 10%.

Comparing Long-Term Performance

When comparing long-term returns, the stock market has historically outperformed gold. For example, if you had invested $10,000 in the S&P 500 in 1980, reinvesting dividends, your investment would be worth over $1 million today. The same investment in gold would be worth around $150,000.

That said, gold can serve as a valuable hedge. During periods of high inflation or market downturns, gold often holds its value or even appreciates, helping to balance a diversified portfolio.

Risk and Volatility

Stocks are more volatile in the short term but offer higher potential returns. Gold is less volatile and often moves inversely to the stock market, making it a good diversifier. The key is understanding your risk tolerance and investment timeline.

For younger investors with decades until retirement, the stock market may offer the best opportunity for growth. For those nearing retirement or looking to preserve wealth, gold can provide stability and protection against inflation.

Tax Considerations

In the U.S., long-term capital gains from stocks held over a year are taxed at favorable rates (0%, 15%, or 20%, depending on income). Gold, however, is considered a collectible by the IRS and is taxed at a maximum rate of 28% when sold for a profit, even if held long-term.

This tax difference can significantly impact your net returns, especially over time.

Which Is Better for You?

There’s no one-size-fits-all answer. The best strategy often involves a mix of both assets. Financial advisors typically recommend allocating 5-10% of your portfolio to gold as a hedge, with the majority invested in diversified stock holdings.

Ultimately, your investment decision should align with your financial goals, risk tolerance, and time horizon. Regularly reviewing and rebalancing your portfolio is essential to stay on track.

Final Thoughts

Both the stock market and gold have their place in a well-rounded investment strategy. While the stock market offers higher long-term returns, gold provides stability during turbulent times. By understanding the strengths and weaknesses of each, you can build a resilient portfolio that supports your financial future.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or tax advice. Always consult with a licensed financial advisor or tax professional before making investment decisions. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal.