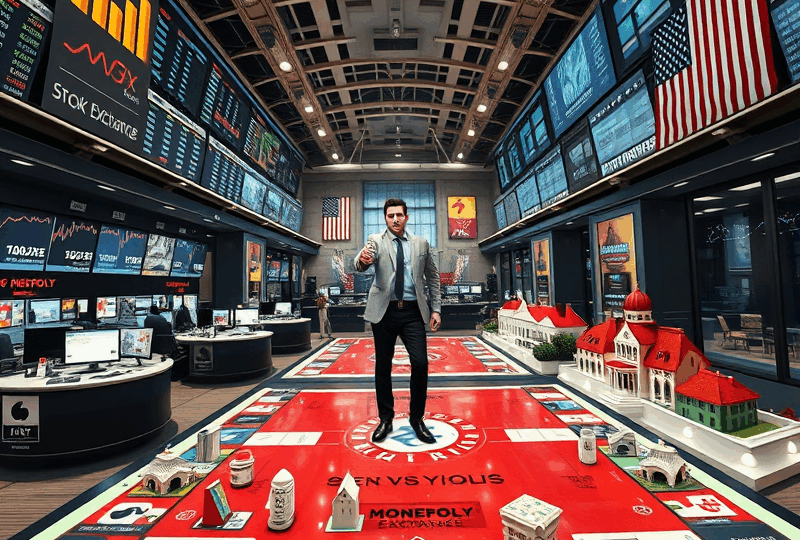

Stock Market vs Monopoly: Understanding Investing Through America’s Favorite Board Game

When it comes to learning about investing, few tools are as surprisingly insightful—and fun—as the classic board game Monopoly. While Monopoly is often associated with family game nights and childhood memories, it also offers a simplified, yet surprisingly accurate, representation of many core investment principles. In this article, we’ll explore how Monopoly can help Americans understand the stock market, how the two compare, and what lessons we can take from the game to make smarter financial decisions in real life.

What Is the Stock Market?

The stock market is a complex system where shares of publicly traded companies are bought and sold. In the U.S., the two largest stock exchanges are the New York Stock Exchange (NYSE) and the Nasdaq. Investors purchase stocks to gain partial ownership in companies, hoping their value will increase over time. Stock prices fluctuate based on a variety of factors including company performance, economic indicators, and investor sentiment.

Monopoly: A Simplified Investment Simulator

Monopoly, created during the Great Depression and now a staple in American households, simulates property investment. Players buy, trade, and develop properties to accumulate wealth and bankrupt their opponents. While it doesn’t include stocks or bonds, the game teaches key investment concepts such as risk-taking, cash flow management, asset diversification, and the importance of long-term strategy.

Comparing Monopoly and the Stock Market

Let’s break down the similarities and differences:

- Risk and Reward: In both Monopoly and the stock market, higher risk can lead to higher rewards. Buying Boardwalk and Park Place is akin to investing in high-growth stocks—potentially lucrative but expensive and risky.

- Diversification: In Monopoly, owning properties across different color groups can spread risk. Similarly, in the stock market, diversification across sectors or asset classes helps reduce portfolio volatility.

- Cash Flow: Rent collection in Monopoly mirrors dividend income in the stock market. Both represent passive income streams that can be reinvested or used to fund other opportunities.

- Market Timing: Just as landing on a valuable property early in the game can be a game-changer, timing matters in the stock market. However, trying to time the market is risky and often discouraged by financial advisors.

What Monopoly Teaches About Real-World Investing

Monopoly emphasizes the importance of patience, strategy, and long-term thinking—traits that are equally valuable in stock investing. Here are a few takeaways:

- Start Early: The earlier you begin investing, the more time your money has to grow through compound interest.

- Think Long-Term: In both Monopoly and investing, short-term wins are exciting, but long-term planning is what leads to success.

- Manage Liquidity: Running out of cash in Monopoly can force you to mortgage properties or sell assets. In real life, having an emergency fund and managing liquidity is crucial.

- Adapt to Change: The game’s Chance and Community Chest cards introduce unexpected events—just like real-world market volatility. Flexibility and risk management are key.

Limitations of the Analogy

While Monopoly offers useful insights, it’s important to recognize its limitations. The game is zero-sum—one player’s gain is another’s loss—whereas the stock market can create value for all participants. Monopoly also lacks elements like taxes, inflation, and regulatory oversight, which are critical in real-world investing.

Educational Value for Families and Beginners

Using Monopoly as a teaching tool can be especially effective for families. Parents can introduce children to financial concepts in a fun, engaging way. For adults new to investing, the game can help demystify terms like ROI (Return on Investment), leverage, and capital appreciation.

Conclusion: Bridging the Gap Between Game and Reality

While Monopoly is not a substitute for real-world financial education, it provides a foundational understanding of investing principles. By recognizing the parallels between the game and the stock market, Americans can build financial literacy in an accessible and enjoyable way. Whether you’re rolling dice or reviewing your portfolio, the key to success lies in strategy, patience, and informed decision-making.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, including the potential loss of principal. Always consult with a licensed financial advisor or investment professional before making investment decisions. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of any financial institution.