The Magic of Compound Interest: Why You Should Start Investing Early

Hello, future-focused friends! Have you ever thought about how your money could grow not just from saving, but by actually working for you? We all have financial dreams, whether it’s a comfortable retirement, buying a home, or simply building a secure future. Saving money is a fantastic habit, but there’s a powerful force in the financial world that can take your savings and potentially multiply them significantly over time. It’s often called the “eighth wonder of the world,” and it’s known as compound interest. You might have heard the term, but do you truly understand its incredible power, especially when you start early? Perhaps you’ve wondered, “How can my small savings really make a big difference?” or “Is there a secret to growing wealth over the long run?” You’re asking the right questions! The purpose of this article is to unveil the magic of compound interest and show you exactly why starting to invest early is one of the smartest financial decisions you can ever make. Let’s explore how time and consistent effort can turn modest beginnings into substantial wealth.

Beyond Simple Saving: The Need for Growth

Saving money is the essential first step in building financial security. Having an emergency fund and saving for short-term goals in a safe place like a bank account is fundamental. However, when we look at long-term goals – those that are years or even decades away – relying solely on traditional savings accounts can be a challenge. The main reason? Inflation. Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, the purchasing power of currency is falling. If the interest rate you earn on your savings is lower than the rate of inflation, your money is actually losing value over time in terms of what it can buy. For example, if inflation is 3% per year and your savings account pays 1% interest, your money’s purchasing power decreases by 2% annually. Over many years, this erosion of value can be significant, making it harder to reach those long-term goals. This is where investing comes in. Investing involves putting your money into assets like stocks, bonds, or real estate with the expectation that they will generate returns (income or appreciation) that can outpace inflation and grow your wealth over the long haul. And the engine that drives this long-term growth is compound interest.

Unlocking the Magic: What is Compound Interest?

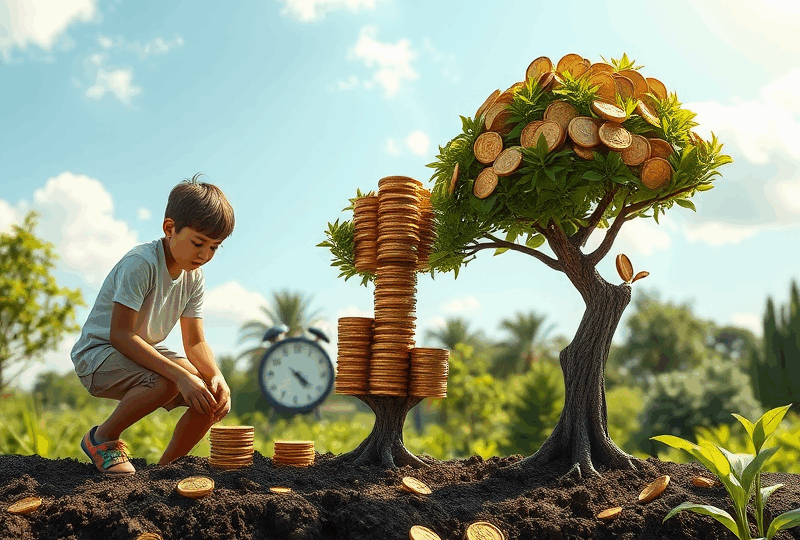

Compound interest is often described as “interest on interest.” It’s the process where the interest you earn on your initial investment (the principal) is added back to the principal, and then the *next* interest calculation is based on the *new, larger* total. This creates a snowball effect, where your money grows at an accelerating rate over time. With simple interest, you only earn interest on the original principal amount. With compound interest, your earnings start earning earnings themselves. The longer your money is invested and compounding, the more powerful this effect becomes. It’s not a linear growth; it’s exponential growth. Imagine planting a single seed that not only grows into a plant but also produces more seeds that grow into more plants, which in turn produce even more seeds. That’s the essence of compounding – your initial investment generates returns, and those returns become part of the base that generates even more returns, and so on.

Why Starting Early is the Ultimate Advantage

Understanding compound interest immediately highlights the single most important factor in maximizing its power: time. The longer your money has to compound, the more dramatic the results will be. This is why starting to invest early, even with small amounts, provides an incredible advantage over waiting until later in life, even if you can invest larger sums then. Let’s illustrate this with a classic conceptual example:

Imagine two friends, Emily and David, both want to save for retirement. They both earn an average annual return of 7% on their investments.

- Emily starts at age 25. She invests USD 300 per month for 10 years (until age 35), contributing a total of USD 36,000. After age 35, she stops contributing any new money but leaves her investments in the market to grow until age 65.

- David waits until age 35 to start. He invests USD 300 per month for 30 years (until age 65), contributing a total of USD 108,000.

Who do you think ends up with more money at age 65? Surprisingly, in this scenario, Emily, who invested for only 10 years but started early, could potentially end up with significantly more money than David, who invested for 30 years but started later. Why? Because Emily’s initial contributions had an extra 10 years to compound *before* David even started investing. Those early years allowed her money to grow substantially, and that larger base continued to compound for decades. David invested three times as much money (USD 108,000 vs. USD 36,000), but he missed out on those crucial early years of compounding. This example, while simplified, powerfully demonstrates that time in the market, especially early on, can be far more impactful than the total amount invested later.

Starting early allows your money to benefit from more compounding cycles. Each cycle builds on the previous one, creating exponential growth. Delaying even just a few years in your 20s or 30s can mean missing out on a substantial amount of potential growth over a lifetime of investing. Time is a non-renewable resource, and in the world of compounding, using it early is the key to unlocking its full magic.

The Interplay of Time, Rate, and Contributions

While time is the most critical factor for compounding, the rate of return and the amount you contribute also play important roles. A higher rate of return will accelerate compounding, and larger or more frequent contributions will increase the base upon which compounding occurs. However, the rate of return is often influenced by market conditions and the types of assets you invest in, which can be less predictable. The amount you can contribute might be limited by your current income and expenses. But the one factor you have the most control over, especially when you are young, is *when* you start. By starting early, you give even modest contributions and reasonable rates of return the longest possible runway to work their magic. Don’t feel discouraged if you can only start with a small amount. The power of compounding over decades can turn those small, consistent contributions into a significant nest egg.

Overcoming the Barriers to Starting Early

Many people understand the idea of investing but delay starting for various reasons. Common barriers include:

- “I don’t have enough money to invest.” This is a very common feeling, especially when you’re young and just starting out. However, thanks to modern investing platforms, you don’t need a large sum to begin. Many brokers have no account minimums, and you can start investing with as little as USD 25 or USD 50 per month. The key is consistency, not starting with a fortune. Remember the power of compounding on even small amounts over decades.

- “I don’t know how to invest.” The world of investing can seem intimidating with its jargon and options. But you don’t need to be an expert to start. Simple, low-cost options like diversified index funds or ETFs (Exchange Traded Funds) allow you to invest in a broad basket of stocks or bonds with a single purchase. These are often recommended for beginners because they provide instant diversification and track the performance of the overall market or a specific segment. Commit to learning gradually as you go.

- “The market seems too risky right now.” Market volatility is a normal part of investing. Prices go up and down. Trying to time the market – waiting for the “perfect” moment to invest – is notoriously difficult and often leads to missed opportunities. For long-term investors, focusing on consistent investing over time (Dollar-Cost Averaging) helps mitigate the risk of investing a large sum right before a downturn. Remember, you’re investing for decades, not days or weeks.

- “I have other financial priorities.” While it’s crucial to have an emergency fund and manage high-interest debt, try to find even a small amount to start investing alongside these priorities. The earlier you start, the less you may need to save later to reach your goals, thanks to compounding.

Recognizing these barriers and taking small, actionable steps to overcome them is crucial for unlocking the benefits of starting early.

Practical Steps to Start Your Compounding Journey Now

Ready to put the magic of compound interest to work for you? Here are some practical steps you can take to start investing early:

- Set Your Financial Goals: What are you investing for? Retirement? A future down payment? Having clear goals will help you stay motivated and determine your investment timeline and risk tolerance.

- Create a Budget: Understand where your money is going. Find even a small amount you can consistently set aside for investing each month. Automating this transfer can make it easier.

- Open an Investment Account:

- Retirement Accounts (Tax-Advantaged): If you have access to a 401(k) or 403(b) through your employer, this is an excellent place to start, especially if your employer offers a matching contribution (that’s free money!). If not, consider opening an Individual Retirement Arrangement (IRA), either a Traditional or Roth IRA, which offer significant tax advantages for retirement savings.

- Taxable Brokerage Account: For goals other than retirement, you can open a standard brokerage account with an online broker.

Research different brokerage firms based on fees, investment options, and ease of use.

- Choose Your First Investments: For beginners, low-cost, diversified index funds or ETFs are often recommended. These allow you to invest in a broad segment of the market (like the S&P 500) with a single investment, providing instant diversification.

- Set Up Automatic Investments: Once your account is funded and you’ve chosen your investments, set up automatic contributions from your bank account to your investment account on a regular schedule (e.g., monthly or bi-weekly). Then, set up automatic investments from your cash balance into your chosen funds. This automates the process and ensures you invest consistently, benefiting from Dollar-Cost Averaging.

- Commit to Continuous Learning: You don’t need to be an expert, but commit to learning more about investing over time. Read reputable financial resources, listen to podcasts, and take advantage of educational materials provided by your brokerage.

Taking these steps puts you on the path to harnessing the power of compound interest for your long-term financial benefit.

More Conceptual Examples: Visualizing the Growth

Let’s look at another way to visualize the impact of time and compounding. Imagine investing USD 1,000 one time and letting it grow at an average annual rate of 7%.

- After 10 years, it could grow to approximately USD 1,967.

- After 20 years, it could grow to approximately USD 3,870.

- After 30 years, it could grow to approximately USD 7,612.

- After 40 years, it could grow to approximately USD 14,974.

Notice how the growth accelerates over time. The increase from year 30 to year 40 (over USD 7,000) is larger than the total value after 20 years. This is the magic of compounding at work – the growth in later years is much larger than in earlier years because the base amount is so much bigger. Now imagine this effect applied to regular contributions over decades!

Staying Disciplined Through Market Swings

The journey of investing won’t always be a smooth upward line. The market will experience periods of volatility, with prices going down as well as up. It can be tempting to stop investing or even sell your investments when the market is falling. However, for long-term investors focused on compounding, these periods are actually when your regular contributions (via DCA) buy more shares at lower prices. Staying disciplined and continuing to invest through market downturns is crucial. Remember that compounding works best over long periods, allowing your investments to recover from dips and benefit from subsequent market rebounds. Patience and discipline are your allies in letting compound interest work its full magic.

Your Future Self Will Thank You: Start Today!

The magic of compound interest is a fundamental principle of wealth building. It’s the powerful force that allows your earnings to generate further earnings, creating exponential growth over time. While the rate of return and contribution amounts matter, the single most influential factor you control, especially early in life, is the amount of time your money has to compound. Starting to invest early, even with small amounts, provides an unparalleled advantage that is incredibly difficult to replicate by starting later, even with larger contributions. Don’t wait for the “perfect” moment or until you have a large sum of money. The best time to start harnessing the magic of compound interest was years ago; the second best time is today! Take that first step: set a small amount aside, open an investment account, choose a simple, diversified investment, and set up automatic contributions. Commit to consistency and a long-term perspective. By doing so, you are putting one of the most powerful forces in finance to work for your future self. Wishing you patience, consistency, and the incredible benefits of starting your compounding journey now! 😊