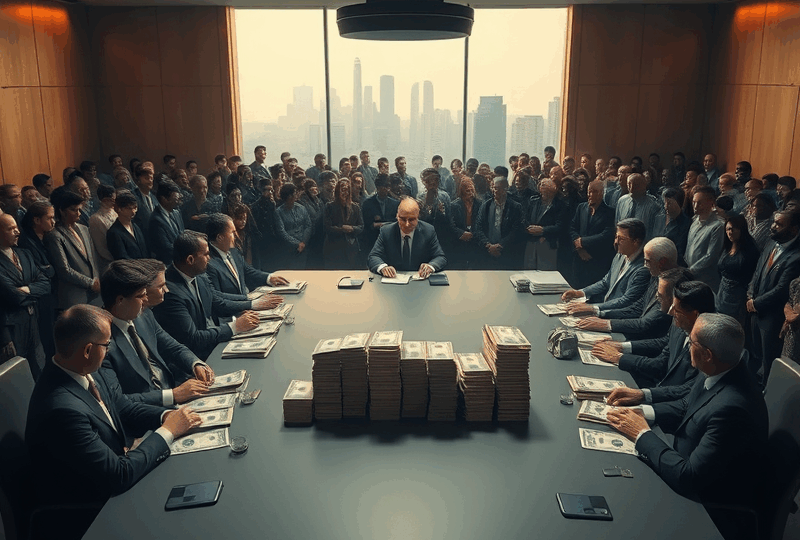

Who Owns 90% of the Wealth in the U.S.: A Deep Dive into America’s Wealth Inequality

Understanding the Basics: What Does It Mean to Own 90% of the Wealth?

In the United States, the top 10% of households control nearly 90% of the nation’s wealth. This figure isn’t just a headline—it reflects a deep structural imbalance in how wealth is accumulated and distributed. According to the Federal Reserve’s Distributional Financial Accounts, as of Q1 2024, the top 1% alone held over 30% of the nation’s total wealth, while the bottom 50% owned just 2.5%. This disparity has grown significantly since the 1980s, driven by asset appreciation, tax policy, and wage stagnation for the middle and lower classes.

Real-World Example: Silicon Valley vs. Rural America

Consider two households: one in Palo Alto, California, and another in rural Mississippi. The Palo Alto family owns a home valued at $2.5 million, has stock options from tech employment, and contributes to a 401(k) matched by their employer. The Mississippi family rents their home, works hourly jobs without benefits, and has no retirement savings. Despite both families working full-time, their ability to accumulate wealth is vastly different. This scenario highlights how geography, industry, and access to financial tools shape wealth outcomes.

Expert Insight: What Economists Are Saying

Dr. Emmanuel Saez, a professor at UC Berkeley and leading expert on income inequality, argues that “wealth concentration at the top is now as high as during the Gilded Age.” In a 2023 paper published by the National Bureau of Economic Research (NBER), Saez and colleagues suggest that current tax structures disproportionately benefit capital over labor, exacerbating inequality. They advocate for wealth taxes and more progressive income taxation to rebalance the system.

Statistical Breakdown: Comparing Wealth Distribution

| Wealth Group | Share of Total U.S. Wealth (Q1 2024) |

|---|---|

| Top 1% | 30.3% |

| Top 10% | 89.6% |

| Bottom 50% | 2.5% |

Source: Federal Reserve

Why This Matters: Long-Term Economic Implications

When wealth is concentrated in the hands of a few, economic mobility becomes increasingly difficult. A 2024 study by the Brookings Institution found that children born into the bottom 20% of income earners have less than a 10% chance of reaching the top 20% in their lifetime. This lack of mobility undermines the American Dream and can lead to political instability, reduced consumer spending, and slower economic growth overall.

Tools and Strategies: What Can Individuals Do?

While systemic change is essential, individuals can take steps to build and protect wealth. Tools like Roth IRAs, Health Savings Accounts (HSAs), and low-cost index funds offer tax advantages and long-term growth potential. Platforms like Fidelity and Vanguard provide educational resources and automated investing options. Additionally, understanding credit, avoiding high-interest debt, and leveraging employer-sponsored retirement plans can make a significant difference over time.

Personal Reflection: Living Within the Divide

As an American living in a mid-sized city, I’ve witnessed firsthand how wealth inequality shapes neighborhoods, schools, and opportunities. Friends working in tech have seen their net worth soar through stock grants, while others in education or retail struggle to afford housing. These experiences underscore the importance of financial literacy and the need for policy reform that supports equitable wealth building.

Conclusion: Bridging the Gap Requires More Than Awareness

Wealth inequality in the U.S. is not just a statistic—it’s a defining feature of our economy. Addressing it requires a combination of individual action, corporate responsibility, and government policy. By understanding the mechanics behind the numbers and advocating for fairer systems, we can work toward a more inclusive financial future.

Disclaimer

This blog post is for informational purposes only and does not constitute financial, legal, or investment advice. Always consult with a certified financial advisor or tax professional before making financial decisions.

Author

Michael J. Lee

Financial blogger and U.S.-based wealth analyst with over 10 years of experience in economic research and personal finance education.